Introduction:

While M&A processes have not radically changed over the last few decades, we cannot deny the sweeping rise of M&A software, which has gained popularity due to improved technology and an overwhelming desire for efficiency. What makes shopping for M&A software challenging, however, is these so-called M&A software providers that are actually no more than VDR providers crowding the market. It should go without saying deal software must do more than securely store documents; practitioners need CRM and pipeline management, synergy tracking, help expediting due diligence, and a smooth transition to integration via early and streamlined integration planning. With this in mind, in order to simplify your M&A software shopping, we present below an overview of M&A software benefits and providers.

What is M&A Software?

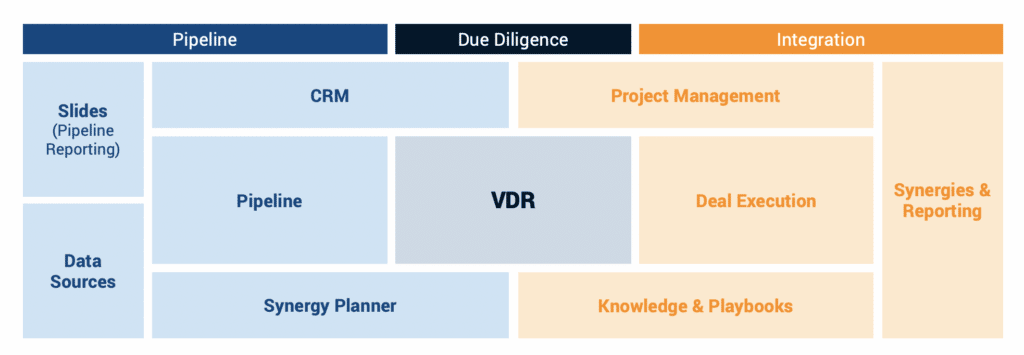

M&A software allows for the organized and systematic management of the processes and workstreams during mergers and acquisitions. More specifically, M&A software should cover the entire deal lifecycle from target sourcing, pipeline management and synergy planning to due diligence and finally to integration – although many platforms on the market are specific to deal stage and type.

What are the Benefits of Leveraging M&A Software?

Undoubtedly, there are numerous benefits to using M&A software, stemming from security to workflow. Key benefits include:

Strengthened focus on value creation – Some deal software includes features that help practitioners remain focused on their deal theses and valuation creation throughout the often chaotic life cycle of the deal. Value creation has long been the dark horse of M&A – it tends to get pushed to the side in too many deals once due diligence begins. Value creation features include: thesis planners, synergy planners, and synergy trackers. A strong deal thesis leads to improved and informed questions during due diligence, which results in captured synergies (or the important realization that the deal is not for you).

Access to actionable M&A data and analytics and simplified reporting -The analytics some M&A software provides are invaluable from both an information standpoint and an efficiency standpoint. For instance, you want to select a provider that offers up-to-date analytics on your pipeline, as well as allowing you to produce PowerPoints, 1-pagers, and Excel spreadsheets with the click of a button; this will make Corporate Development’s life much easier, allowing Corporate Development to focus on M&A versus content creation. Be aware that not all providers are created equal when it comes to analytics.

Enhanced transparency and collaboration – Deal execution benefits greatly from the real-time transparency M&A software can provide. With team members collaborating in real time and focusing on one source of truth, M&A software breaks practitioners and teams out of traditional silos. Time-killers such as looking through emails, working on the wrong version of a document, or completing a task that has (yikes) already been completed, are eliminated Moreover, this enhanced transparency and collaboration often result in improved communication between stakeholders, as well as the ability to spot potential roadblocks and red flags that could put the deal thesis and/or timeline at risk.

Improved workflow – In a similar vein, amplified transparency and collaboration lead to improved workflow, breaking teams out of the traditional silos associated with M&A and project management. Teams align themselves around critical tasks and goals and increase their focus on the overarching deal objectives.

Secure document storage – M&A software with built in VDRs allows for easy and secure document storage and file sharing. This is perhaps one of the most widely utilized components of M&A software.

What Features Should I Look For in M&A Software?

Robust security – It is undeniable that secure document storage is a critical component of M&A software; therefore, security certifications should be a critical component of your decision making. Look for ISO27001 certification which is the international standard. Any additional certifications, such as EU-U.S. Privacy Shield Framework and GDPR compliant, increase the provider’s credibility and security rating. Additional security features for the software’s built-in VDR include: specific permission settings (who can and who cannot see documents), as well as settings such as view only, two-factor authentication, water-marking, and audit logs.

Ease of use and customer service – If the software you select is not intuitive and easy to use, you will be facing the difficult task of rallying team members and stakeholders around the new software. M&A software should ease deal stress, not add to it. Ask yourself: is it simple to onboard users and adapt to the software? On a related note, how is the provider’s customer service? What type of reviews does the provider get online (legitimate reviews – not paid for reviews – do your homework).

End-to-end service – Without a doubt, after security, what truly separates current M&A software providers is that many do not offer end-to-end service. Using separate M&A software or M&A tools for pipeline management, due diligence, and integration is an antiquated way of working that slows the deal’s execution and puts value creation at risk.

Cost – As with any major purchase, cost will play a key role in your decision. Again, finding an end-to-end solution versus using multiple tools will help you by allowing you to plan for costs and work with one provider. Be sure to keep an eye out for any hidden costs or fees associated with the software.

Synergy planning – Synergy planning is one of the most powerful tools M&A software can provide.

Who Are the Major M&A Software Providers?

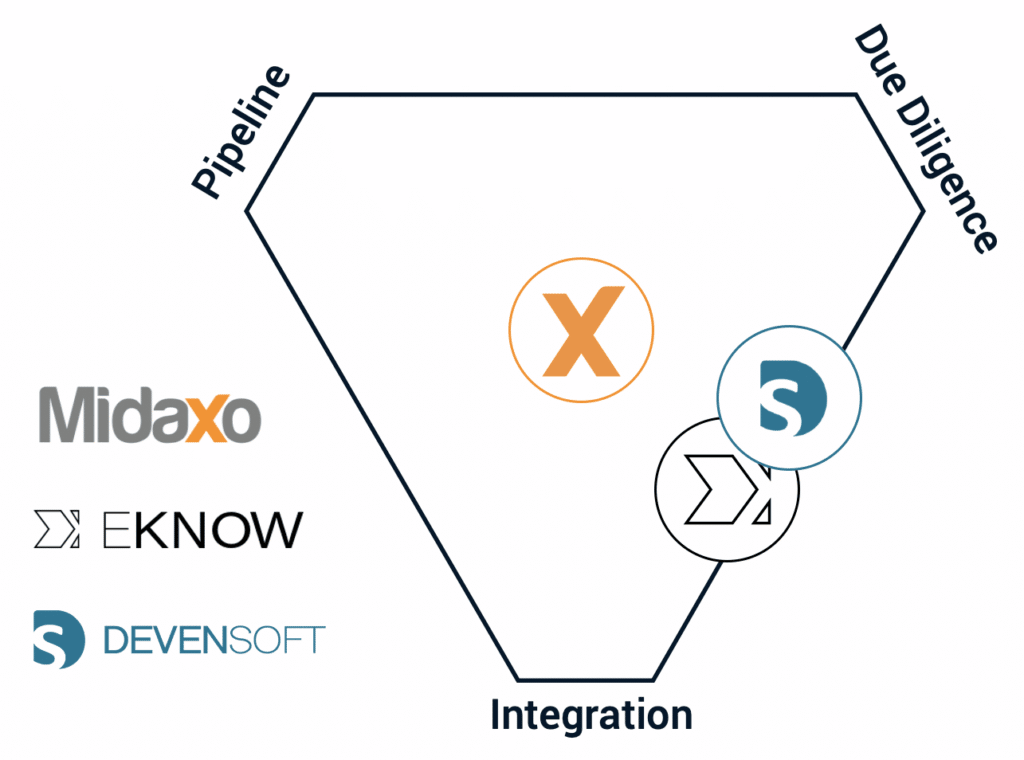

Comprehensive M&A software companies offer a wide range of features across the entire lifespan of a deal. Companies such as EKNOW and Devensoft have strengths in certain use cases, but lack functionality such as a VDR integration. The only provider covering all use cases and features below is Midaxo. Other M&A software providers are more specific to one use case or feature.

Midaxo, EKNOW, and Devensoft by Use Case Strengths

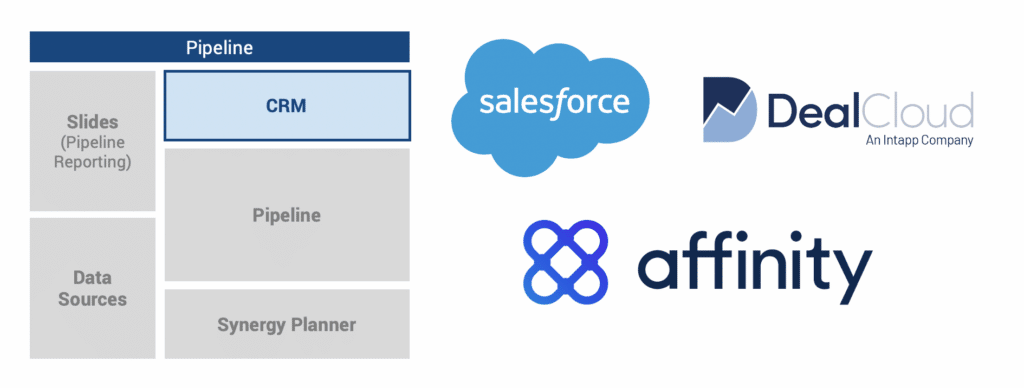

CRM Companies:

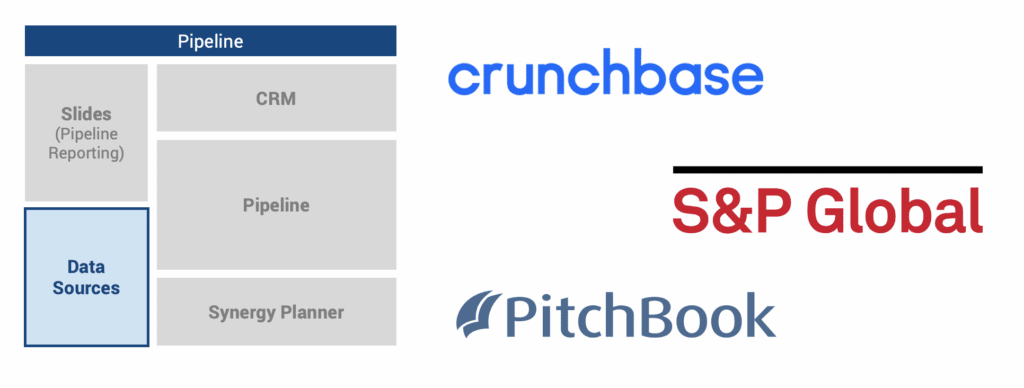

Data Source Companies:

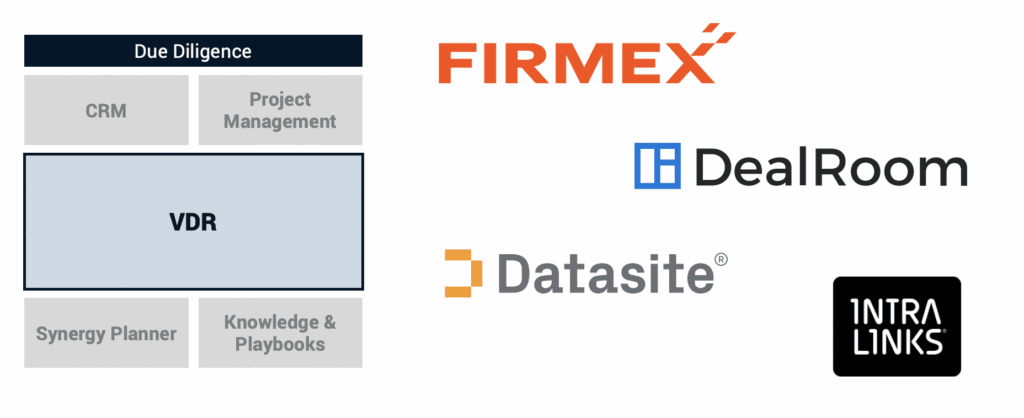

VDR Companies:

Project Management Companies

Concluding Thoughts:

Ultimately, M&A software is meant to make the work associated with deals easier to complete. While multiple platforms may accomplish this goal, very few are also easy to use and easy to buy. What does this mean? Simply put, your M&A software should provide end-to-end coverage so you are not constantly switching tools, adjusting to new platforms, transferring (and let’s face it, most likely losing) information, and paying separate bills. The takeaway? Look for one secure solution, one tool that fills the void between point-to-point solutions.