This post was originally published in November 2021 and updated in August 2022 to include up-to-date information.

Introduction

Companies engaged in the world of M&A need to be focused in their intent and execution of deals if they are to realize maximum value from deals. How best to do this? First, an overarching strategy must be identified and a deal thesis stated—this is the ultimate roadmap to successful deals. From there, specific goals must be enumerated and established as goal posts to achieve deal success.

Once this framework is established, companies can begin to identify and assess targets that will lead them to fulfillment of their broad strategy and goals. Below we will discuss how to apply data driven scores to the M&A target and deal process and address the distinction between target scoring and deal scoring.

Deal Scoring vs. Target Scoring

Simply put, target scoring focuses on potential target companies, while deal scoring focuses on the transaction itself. The importance of this distinction is critical since target scoring allows for a clear, concise picture of what targets best fit the acquirer’s deal strategy and goals—eliminating wasted time, money and resources on targets that will ultimately fall short of reaching an acquirer’s required deal value.

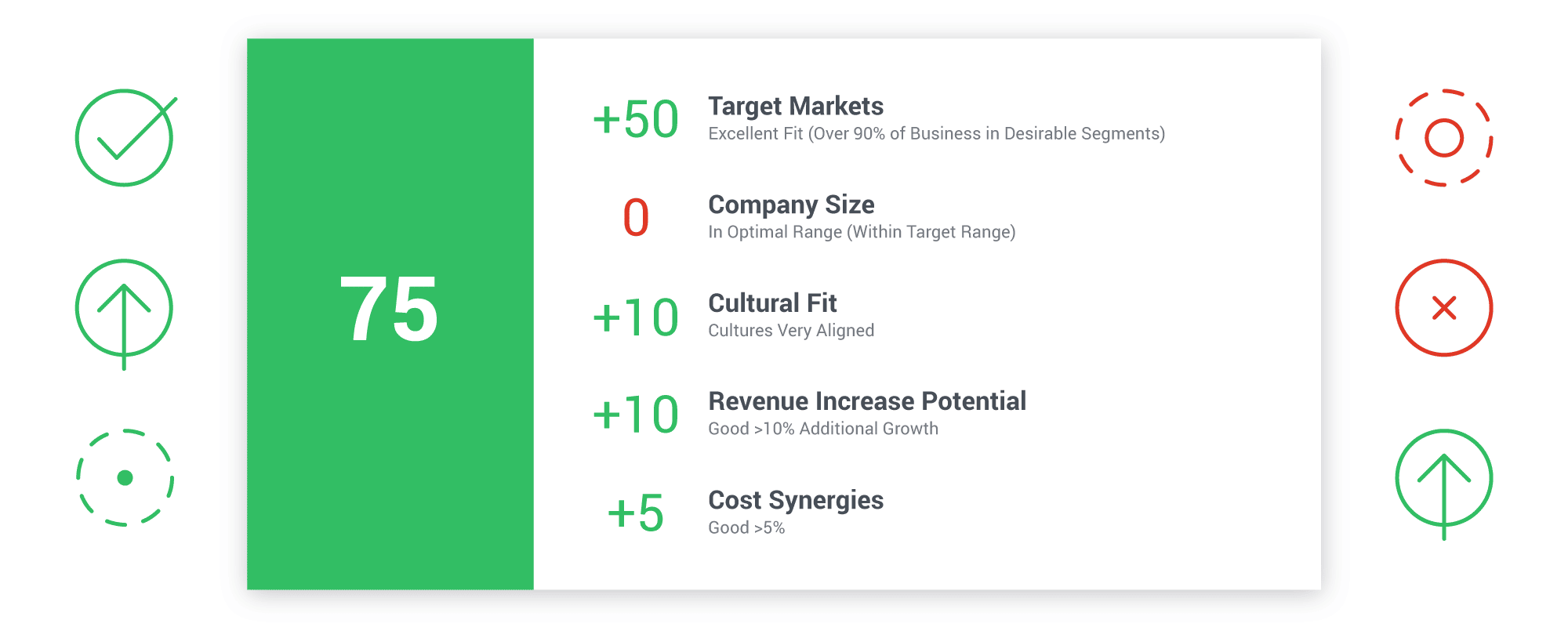

Midaxo’s Pipeline+ platform allows acquirers to assign numerical values to potential targets based on established metrics aimed at achieving deal success. This approach basically provides a “go/no go” approach to pursuing targets that fit the acquirer’s defined strategy and expedites the formulation of a deal thesis. See how Pipeline+ functions and view a theoretical example here.

The inherent beauty of this tool is its ability to adapt to changing metrics and goals as acquirers react to both internal and external changing market conditions.

Target Scoring Best Practices for Frequent Acquirers

Frequent acquirers adhere to several best practices when engaging in target scoring to assure their process is both robust and crafted to achieve desired deal value. Key practices are:

- Establish a sound acquisition strategy – Any attempt to engage in M&A must first be based on a concrete, sound acquisition strategy that mimics acquirers’ overall stated company goals and objectives. For example, is the acquirer looking to grow in established markets, or pursue growth in new markets with new products?

- Screen target against the first layer of screening criteria – Once metrics are established that will help evaluate the worthiness of potential targets vis-a-vis acquirer’s strategic goals (perhaps size, geography, profitability, market share, synergies etc.), specific data for each target can be assessed and compared both to other targets and to established deal thesis values. At this stage, it is key to not make the screening criteria too narrow. Criteria should be fairly broad, yet clear, so potentially good targets are not eliminated too soon in the process.

- Narrow down to a higher level of justification – Once initial target screening is done, attention can now be focused only on those targets with real potential to meet established deal goals. With this narrowed focus, target evaluation can be directed toward identifying the best fit target to realize the acquirer’s expected deal value.

- Be aware of common target red flags – Awareness of possible target red flags such as possible litigation, tax liabilities, environmental concerns, and/or unrealistic valuations and projections is critical to not focusing on a target that will bring significant post merger headaches and lost deal value.

- Target criteria should be living and breathing – Acquirers must always be ready to pivot as business and markets change. This is especially true in the area of target evaluation criteria—it cannot be static, but rather needs to be adaptive to both updates to the acquirer’s strategy and to market conditions. As a result, leveraging a tool can be extremely beneficial, saving time, money, and energy.

Once the most appropriate target to achieve an acquirer’s deal objectives and identified deal value is selected, the deal moves beyond target scoring to the ultimate acquisition implementation phase. Of course, M&A professionals realize there is no hard line between actions here—they are always thinking about due diligence and implementation at all phases of the M&A process.

Current Trends in Target Scoring

Below is what we’re observing as acquirers’ current approach to target scoring:

- With a stronger emphasis on the pulse of the market, target scoring is turning into more of an “outside-in” philosophy than an “inside-out” one (focus on the acquirer).

- Dovetailing the “outside-in” approach is the continued necessity for the screening process, but the top of the funnel needs to begin broader, otherwise valuable opportunities can, and will, be missed.

- Acquirers should begin with a list of companies that generally meet their criteria. Keeping the overarching deal strategy and loose screening process in mind, then place an emphasis on 4-6 key metrics.

- Making use of a tool renders target scoring more methodical and efficient and tends to lead to more lucrative deals. More specifically, use a tool especially designed for the world of M&A.

- Operating a pipeline tool or M&A dashboard also makes it easier for Corporate Development to present on, and speak to, possible targets. This is increasingly important as company boards are becoming more and more active and vocal. A dashboard that updates in realtime and leverages visuals to clearly convey key metrics and analytics is essential to effective target sourcing.

- Moreover, a M&A platform with a focus on moving deals through the pipeline, as well as CRM for the initial courting stages and cultivating relationships, is extremely useful. Platforms like Midaxo which also boast a robust mobile app make CRM and target data collection easy on-the-go.

- Because M&A software, target scoring, and deal scoring platforms are more readily available, a final current trend of acquirers (especially serial acquirers) is to consistently review and prune their long list of potential targets.

Surveys of business executives confirm M&A activity is expected to continue as a major business practice for the foreseeable future, both on the national and international scenes. Given this reality, leveraging platforms such as Midaxo that provide key analytics in clear, concise, and manipulative ways offers the best opportunity for identifying and engaging with M&A targets that will realize maximum deal value, while simultaneously addressing the acquirer’s stated central company strategy.