Traditional due diligence – which relies heavily on static questionnaires, with an expanse of disconnected documents hosted in a separate virtual data room (VDR) – presents an abundance of inefficiencies.

For starters, the acquiring entity runs the risk of having to spend significant resources organizing the data before engaging in analysis that would yield the end benefit of the due diligence process.

Furthermore, the use of a single static spreadsheet inevitably leads to the creation of multiple versions, which allows for changes to get lost in translation. This reality can slow down the due diligence process.

A centralized platform, like Midaxo, enables the buyer to interact with the Seller (who can provide documents or answer questions) while maintaining granular control over access and visibility. This new way of working is a win-win for everyone — a simpler workflow for requesting and providing information, the ability to reference best practices for questions and guidance, context for each document, and peace of mind around the security of sensitive information.

For increased speed in executing target due diligence, here are seven advantages of a hybrid platform like Midaxo:

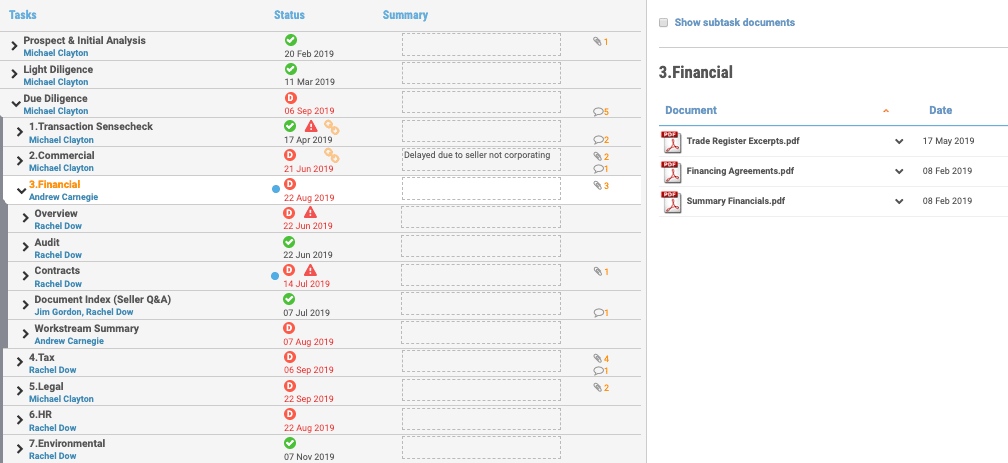

1. Maintain One Location for All Questions and Documents

Create one source of truth with a centralized, cloud-based solution, for collaborative M&A playbook execution and document management. Once you have your data requests in the system as tasks, you can securely invite the Seller into the platform.

The requests in Midaxo make it so that everything is organized with clear context throughout the whole diligence effort. Related questions and documents are connected and uncertainty around requests are quelled with guidance and notes.

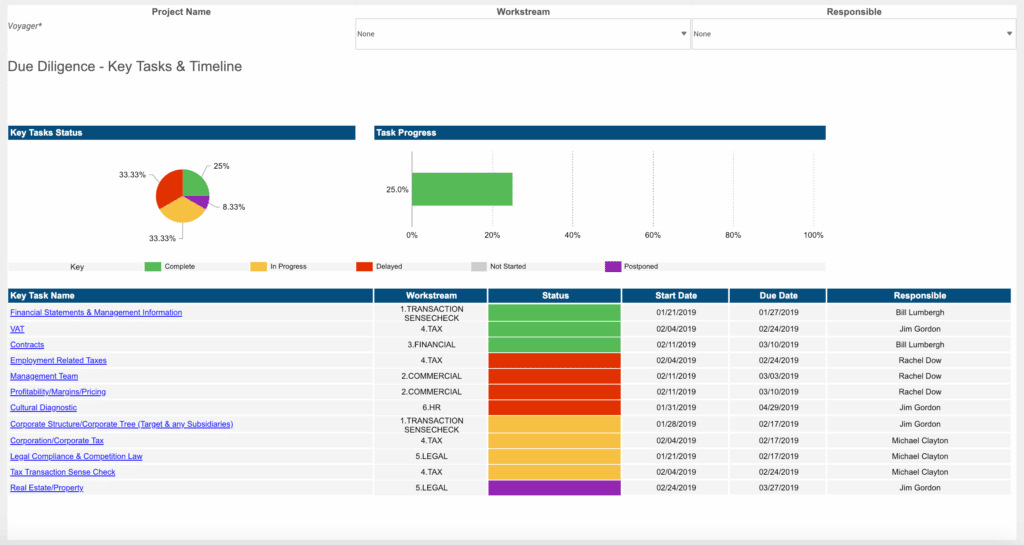

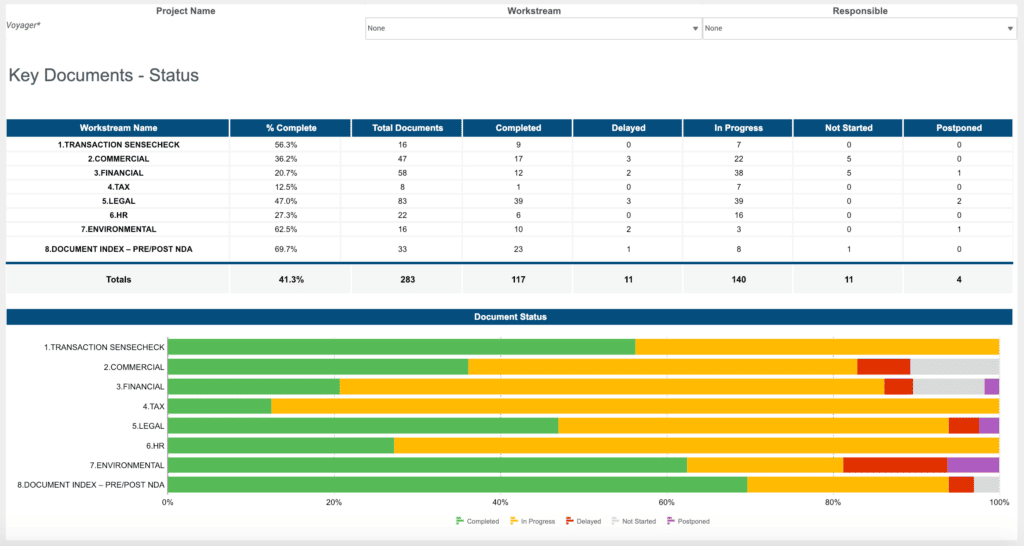

2. Track Progress and Have Visibility with Reporting

With real-time execution in a centralized environment, you can have the visibility you need to report the progress to your team, steering committee, or Board. Track the status of M&A reporting requests with prebuilt dashboards and one-click reports.

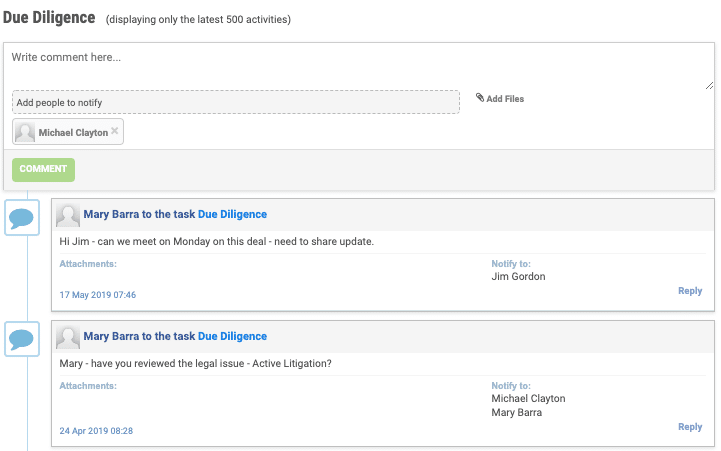

3. Communicate in Real-Time with Seller and Internal Team Members to Answer Questions

Additionally, if a Seller or an internal team member has a question, you can review them all in context as they are asked, instead of dealing with several at a time in a single email or call. Respond to the Seller quickly and with fewer potential miscommunications.

Leverage a project-level email address to ensure every email communication related to the transaction is captured within the project.

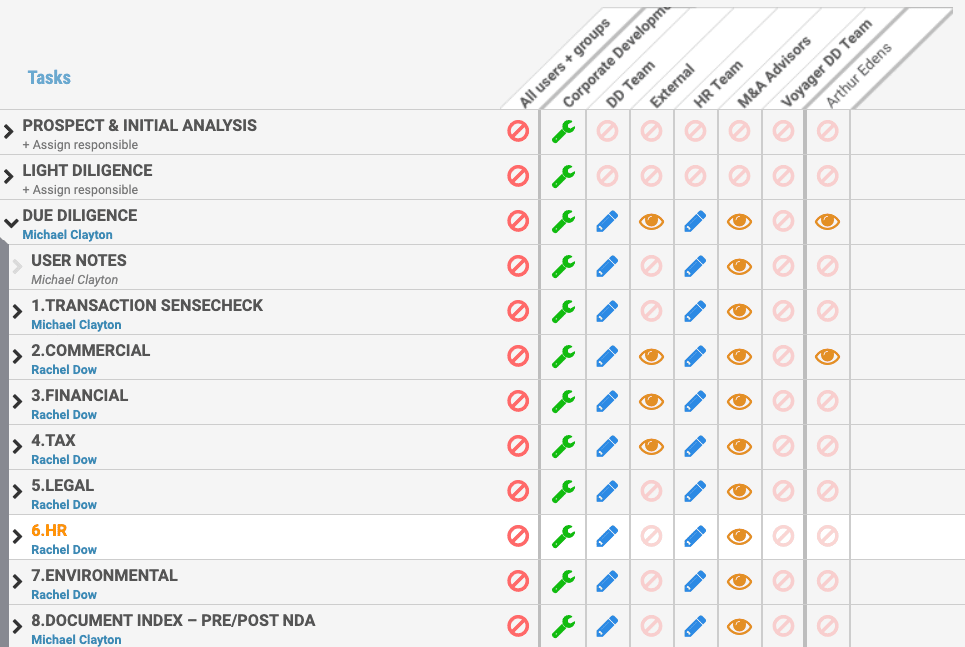

4. Control What Internal and External Team Members See

With flexibility in permission settings, you can control what users see and edit at the task level. In an adjacent task where the Seller has no access, you can make comments or notes that the Seller will not be able to see. You also have the flexibility to set permissions for user groups.

5. Provide Flexibility in the Location of Files

In certain cases, the Buyer entity is unable to dictate where the data will be hosted, leading them to rely on a VDR of the Seller’s choosing. In this case, the VDR links can be stored in Midaxo to give the same guidance and context without needing to upload the file directly into the platform.

6. Stop Reinventing the Wheel for Due Diligence

Having a comprehensive and reusable due diligence playbook saves teams significant time. By enriching your playbook with guidance, you ensure that everyone is attuned to what is needed. Moreover, by adjusting your playbooks with the process-related learnings of previous projects, you add valuable strength for future ones.

With a centralized solution like Midaxo, it is easy to keep your tasks (questions and document requests), and corresponding guidance, organized. To execute a new project, you can start with a template from a previous project, and then invite workstream leads to make edits as needed for the project at hand.

If you aren’t confident in your playbook, don’t worry, you are not alone – less than 5% of respondents felt confident in their playbooks. Midaxo offers Playbooks developed with top M&A practitioners and management consultants.

7. Equip the Integration Team

With an end-to-end platform, you empower the integration management office with the findings from the due diligence process. This will allow the IMO to efficiently plan and effectively execute the post-merger integration steps.

Midaxo is already used in this way by top M&A teams.

“Having transitioned away from the old-style of working, all teams can now work in real-time and are no longer slowed down by the information bottlenecks we experienced with our old systems and working practices.”

– M&A Manager, Daimler

“Our outreach to targets is highly automated and we have a very high close ratio across NDA > LOI > deal execution. Our virtual data room is pre-populated with a number of detailed questions around finance, business operations, technology, HR, legal, etc. and we grant data room access to the target company for the uploading of documents.”

– Head of Corporate Development and Mergers & Acquisitions, Ascensus

“Technology has really expedited the overall M&A process – for example, we have seen significant improvements in collaboration and project speed because we can connect people via the platform to the same source of truth. Additionally, we have been able to reduce the time it takes to run a due diligence project by over 50%.”

– M&A Integration Expert