Note: There is a link to the live Synergy Planner at the end of this page.

M&A due diligence has traditionally focused on skimming through countless legal agreements, financial documents, board meeting minutes, and other materials to spot red flags that might reduce the value of the acquired company.

This due diligence is often performed by external lawyers and consultants with surprisingly little briefing to help them validate the core business assumptions being used to justify the deal. This is no longer sustainable.

An acquirer has to have a solid plan for creating more value through synergies than the price premium paid on the acquisition.

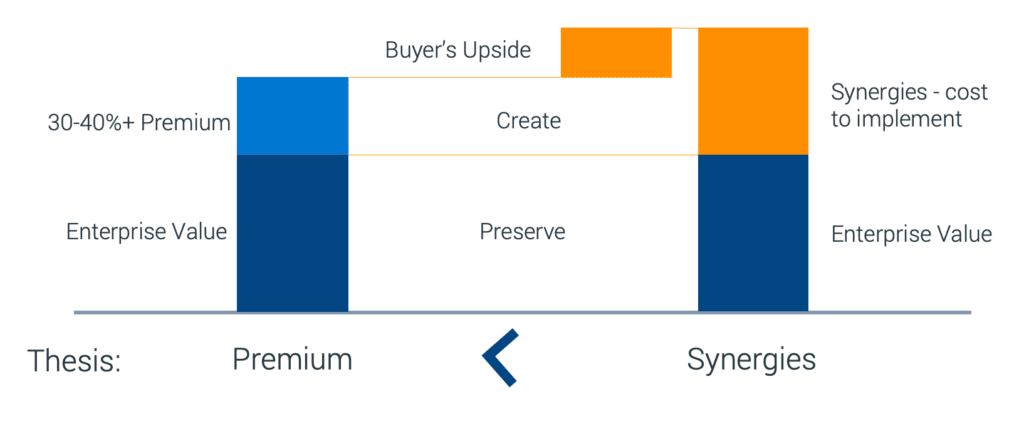

With increasing competition over M&A deals and private equity players entering the market (and now accounting for close to 50% of all acquisitions), deal premiums have increased significantly. On average, a successful M&A bid requires a 30-40% premium in addition to the stand-alone enterprise value of the acquired company. To justify the premium, an acquirer has to have a solid plan for creating more value through synergies than the price premium paid on the acquisition.

Companies have many reasons for doing M&A, but the thesis for the profitability of an individual deal can be simplified as: Premium < Synergies.

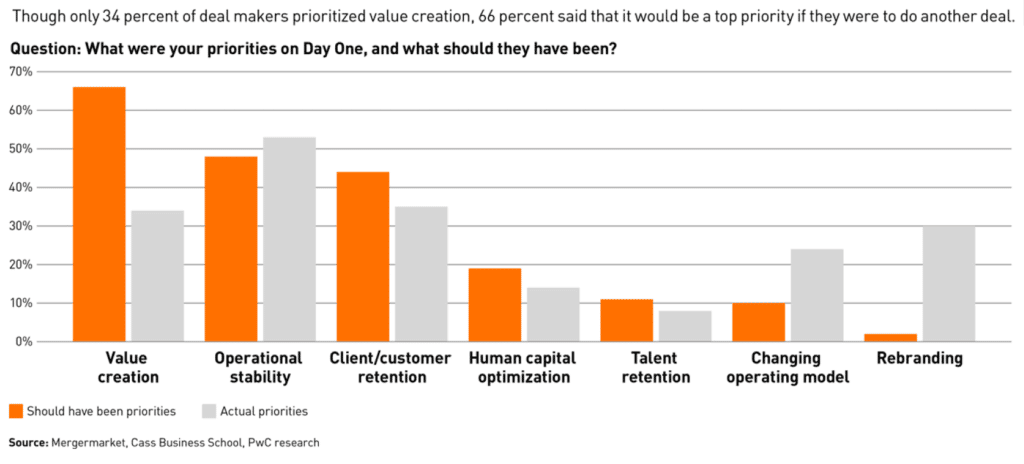

A focus on value creation is often lacking in M&A deals, not only in the due diligence, but even when the deals proceed to Day One of integration. And value creation is the #1 thing that deal makers say they should have focused on.

A Synergy Thesis Shall Drive the Process

To drive an M&A process that focuses on value creation, a thesis for value creation is essential. It should be one of the first things to be established when an acquisition opportunity is being considered. In the beginning of the deal evaluation process, when there is a limited amount of information about the target’s business, the thesis should outline the acquirer’s vision and current best “guesstimate” of the value.

The thesis should clearly outline:

- The main sources for value creation through synergies

- The value of synergies expected from each source

- The key assumptions behind these numbers

The thesis could include high-level assumptions, such as:

- Cross-selling products for a value equal to 30% of target’s revenue

- Increasing the target’s pricing by 20% due to the acquirer’s branding power

- Reducing IT spend by 30% by replacing many IT systems with acquirer’s existing systems

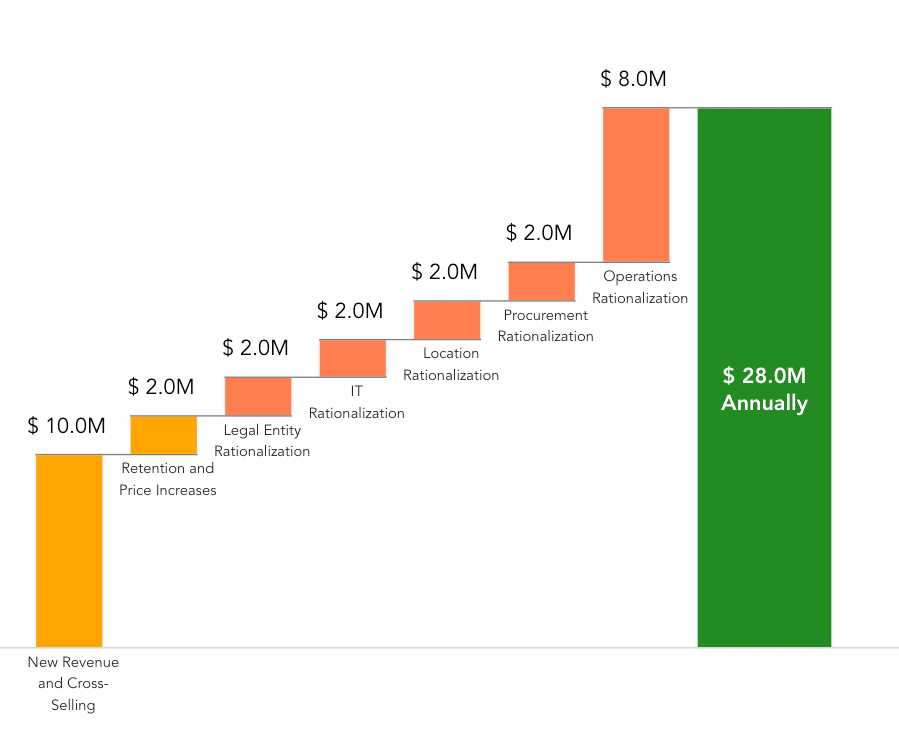

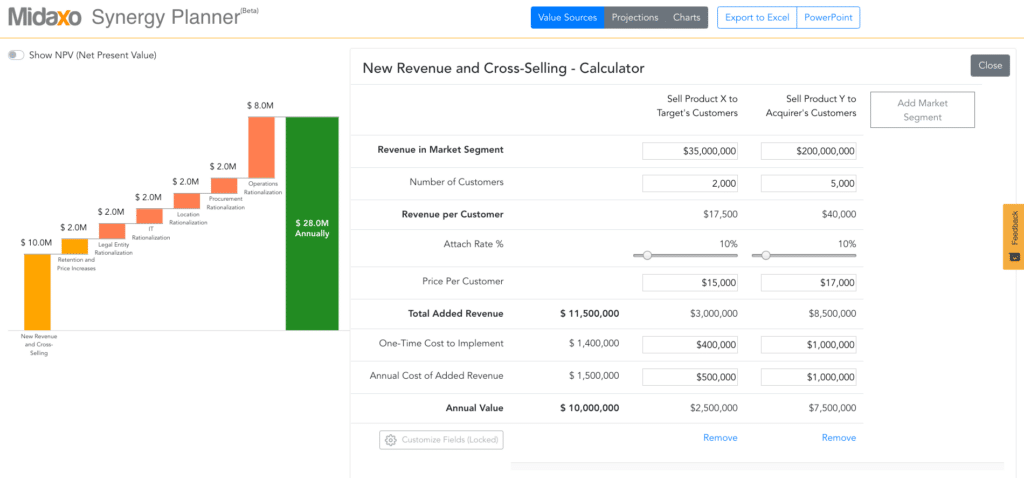

Example of a Value Creation Bridge:

Example of Assumptions behind New Revenue and Cross-Selling Estimates:

| Sell Product X to Target’s Customers | Sell Product Y to Acquirer’s Customers | |

| Revenue in Market Segment | $35,000,000 | $200,000,000 |

| Number of Customers | 2000 | 5000 |

| Revenue per Customer | $17,500 | $40,000 |

| Attach Rate % | 10% | 10% |

| Price Per Customer | $15,000 | $17,000 |

| Total Added Revenue | $3,000,000 | $8,500,000 |

| One-Time Cost to Implement | $400,000 | $1,000,000 |

| Annual Cost of Added Revenue | $500,000 | $1,000,000 |

| Annual Value | $2,500,000 | $7,500,000 |

As the deal progresses to discussions with the target’s management, the thesis should be continuously refined. For example, the cross-selling synergies could be broken down to the level of individual products and target markets. IT synergies could be broken down into more detail about replacing the target’s ERP, CRM, and order fulfillment systems with the acquirer’s systems.

Example of Assumptions behind IT Synergies:

| ERP | CRM | System X | |

| Fate of System | Replaced with a common system | Replaced with a common system | Replaced with a common system |

| Eliminated Annual Costs | $600,000 | $600,000 | $1,000,000 |

| One-Time Cost to Migrate | $100,000 | $100,000 | $50,000 |

| Annual Cost Increase of Replacing System | $100,000 | $100,000 | $50,000 |

| Annual Synergy | $500,000 | $500,000 | $950,000 |

Good Due Diligence Focuses on The Deal Thesis

When the value creation thesis is clearly defined, due diligence can focus on validating the key assumptions behind the thesis. A value creation bridge is a great way to show the most important synergy sources, while underlying assumptions show what has to happen for the synergies from M&A to materialize. From these we can derive excellent due diligence playbooks.

Having a clearly defined value creation thesis completely changes how good and informed questions the due diligence team can ask.

Sample due diligence considerations for cross-selling:

- Are the 10% attach rate and $17,500 price-point realistic, based on discussions with the target’s sales VP?

- Is $400,000 enough to launch required marketing campaigns and incentivize the sales force to do the expected amount of cross-selling?

- Is our own sales organization comfortable committing to the estimated sales goals?

- Can our customer support organization handle the expected amount on new business?

Sample due diligence considerations for IT:

- How quickly do contractual obligations allow us to ramp-down ERP costs?

- Is $100,000 a realistic budget for the planned ERP migration? Who would do it?

- Is the $100,000 budgeted for additional user licenses on the acquirer’s ERP system enough?

- On what terms can we reduce support staff for IT systems?

These examples demonstrate how having a clearly defined value creation thesis completely changes the perspective on how due diligence is done and how good – and informed – questions the due diligence team can ask.

Working through these considerations also acts effectively as preparation for the post-merger integration process. The integration planning effort can start from a clearly defined and validated value creation plan that gives the work solid direction.

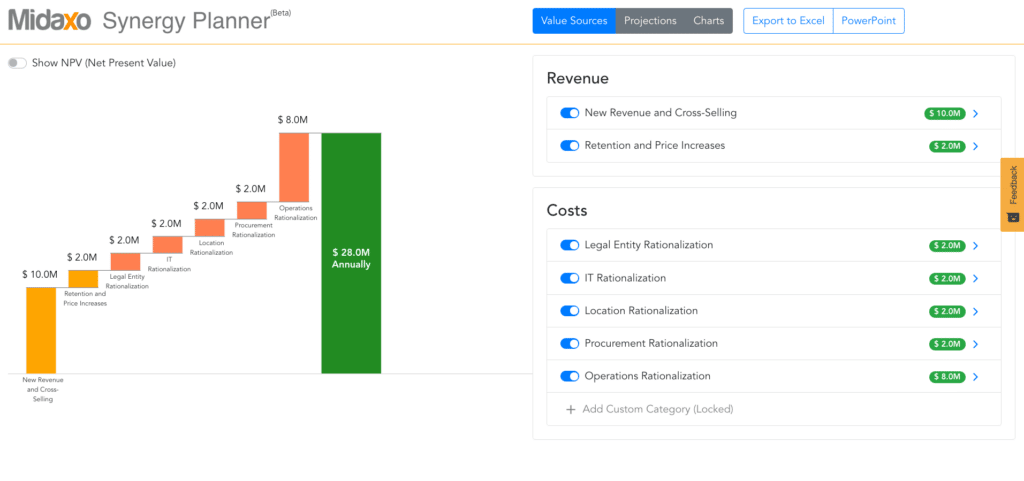

Introducing Midaxo Synergy Planner for Value Creation

For this to work in practice, we need a new kind of M&A solution that makes it easy to establish the thesis and refine it collaboratively throughout the due diligence process.

This is what the Midaxo Synergy Planner is designed for. As the latest addition to Midaxo’s pioneering M&A solutions, it introduces a completely new way to focus M&A deal evaluation and due diligence on value creation.

Different value creation scenarios can be expressed clearly:

The assumptions behind value creation scenarios can be documented easily:

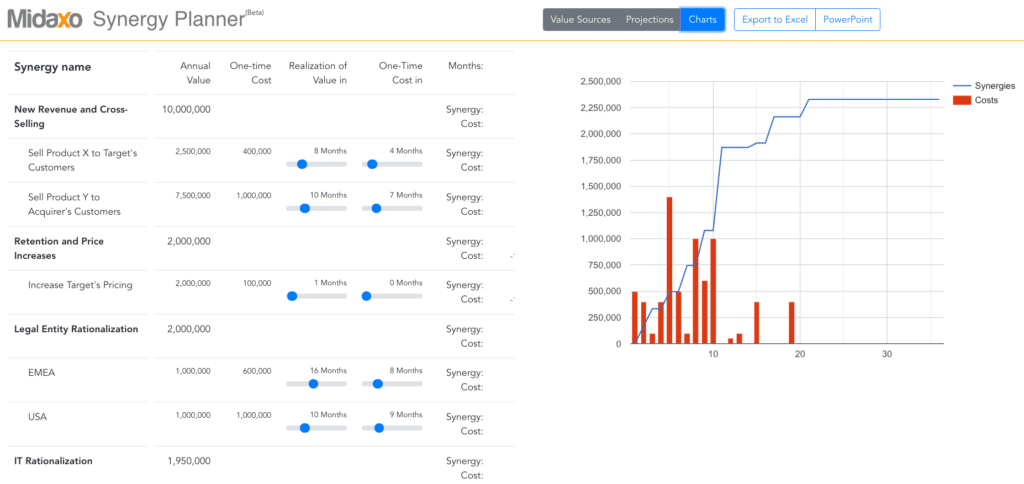

Realization of synergies and implementation cost over time can be projected with ease:

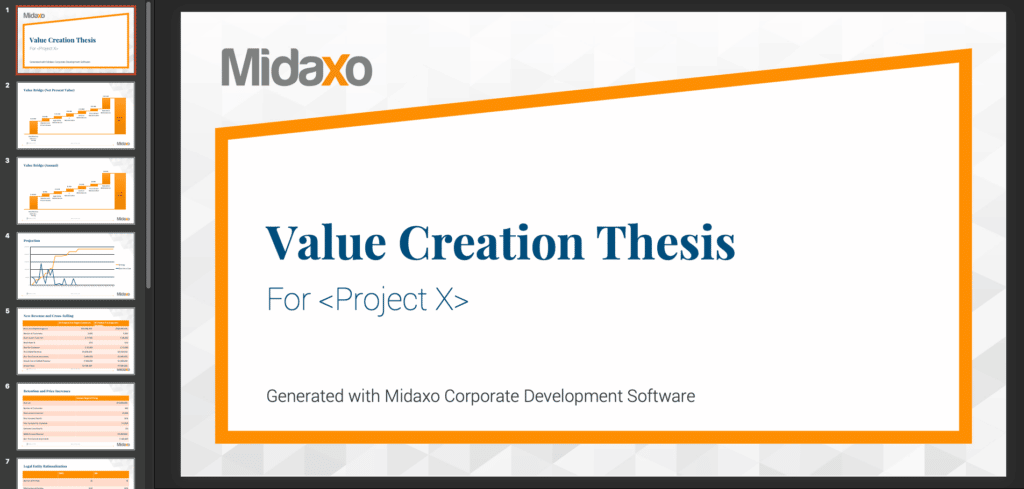

And exporting a professional plan to PowerPoint or Excel is always just one click away:

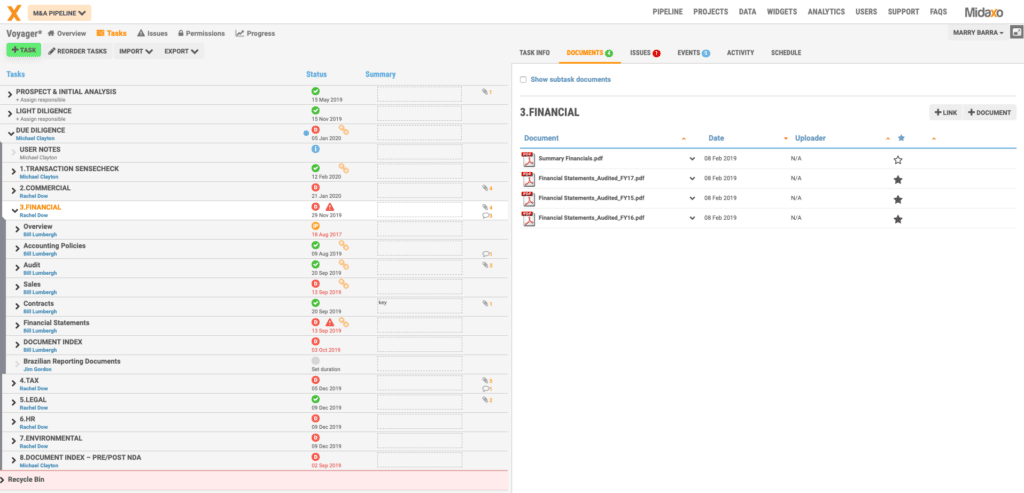

These new capabilities are designed to complement Midaxo’s popular capabilities for deal evaluation and due diligence management. The thesis developed in the Synergy Planner works well with Midaxo’s excellent task management, VDR, and reporting features.

Due diligence task and document management in Midaxo:

Try it for yourself!

We’re excited about this new generation of due diligence management and invite all M&A practitioners to collaborate with us as we refine the design for this pioneering product. The product is currently in beta and we are perfecting the functionality based on customer feedback.

The product is now available, for a limited time, for anyone to experiment with. Try it here and give us your feedback: Midaxo Synergy Planner Demo

We look forward to hearing from you!