Many acquisitions are justified on the basis that they will create synergies – being when the combined post-merger integration value of two companies working as one is greater than the aggregated pre-merger value of both companies working independently (the concept of 1 + 1 = 3). Carefully managed, synergies can contribute to value beyond the sum of the parts of two companies – such as via new revenue channels, access to new geographies, cost rationalization, streamlining of operations, divesting of surplus assets and realignment of market positioning. However, the hope of capturing significant synergies is often misplaced as a rationale for M&A. Identifying and estimating synergies requires a judicious and systematic approach – yet even experienced acquirers can be overzealous in their estimates of the value that can be captured by a deal. The approach to identifying and estimating synergies should be one of realism, with focus maintained on protecting existing operations to maximize the chance of a deal being accretive.

Hard vs. Soft Synergies

So-called “hard synergies” are frequently associated with less positive aspects of M&A, such as job cuts and other cost rationalization processes. While this is undoubtedly true in some instances (a newly combined organization is unlikely to require two finance functions, for example) hard synergies can just as easily entail leveraging the increased size of the new organization to benefit from greater bargaining power and economies of scale.

“Soft synergies” may arise via incremental revenue increases facilitated by the new organization. Soft synergies can include accessing new geographies that complement the acquirer’s existing operations – therefore helping create a base from which to grow. If the products/services of the two companies merging have the same target customer base but are sufficiently different, identical or overlapping geographies can be beneficial as the same customers can benefit from access to a wider variety of options – while strengthening the reach of the new organization.

R&D and patents/intellectual property can also be a rich source of soft synergies, since they can foster the development of entirely new product/service offerings. Another “soft” synergy that may arise is a common corporate culture, which can help to unify the new organization and ensure both companies coming together work as one.

Transformational M&A synergies (those associated with creating value by fundamentally transforming core operations, processes and/or business units) can offer significant potential for innovation and breakthrough performance. However, transformational deals involve complexity that can go beyond the capabilities of management – therefore providing the potential to bring operations to a standstill if not properly managed. Capturing transformational synergies typically requires a disproportionate amount of management time – accordingly, companies undertaking transformational deals and looking to capture associated synergies should thoroughly evaluate their ability to do so.

Questions that may be asked internally include:

- Do we possess the capabilities and financial resources necessary for success?

- Do we have commitment from the board downwards?

- Is it possible to maintain business continuity while transformational synergies are captured and value realized?

Identifying Synergies

Potential synergies will first become apparent in the process of researching a target pre-due diligence – however, it is important to note that synergies identified in the early stage of a deal should be regarded as guidelines only. The different methods of estimating synergies can create a wide range of potential valuations for the combined organization. So while acquirers must find resourceful ways to ascertain how a target could be accretive to a new organization, they must also acknowledge that it is not until later in the M&A due diligence process when things become more clear.

Identifying synergies can be especially challenging given the existence of “dis-synergies” – where the combination of two companies can be dilutive, leading directly to underperformance due to, for example, higher than expected customer attrition, decreased employee motivation or lack of a clear strategic direction post-close. Indeed, when two companies in the same industry merge it is possible that combined revenues may initially decline to the extent that operations overlap and some customers become side-lined. For a deal to benefit shareholders, realizable cost-saving opportunities should therefore exist to offset any such revenue reductions. In other words, the synergies deriving from the merger must exceed the value initially lost.

It is not possible to know with complete confidence the extent to which a deal will be accretive (or dilutive if things go wrong) until the post-merger integration steps are well underway. Nevertheless, a comprehensive understanding of synergies at the outset of the acquisition process is important to prevent acquirers from paying an undue premium for a target – or pursuing the wrong deal.

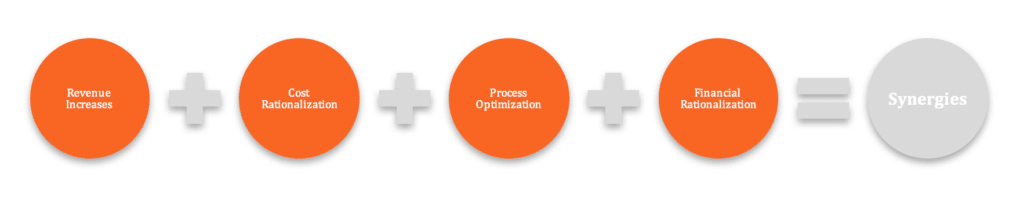

Categorizing potential synergies can provide a useful framework when estimating value. Four principal areas to focus on are:

Estimating Synergies

One approach to estimating synergies requires making assumptions about future cash flows and growth rates. Accordingly, synergies can be estimated by firstly addressing two fundamental questions – what form will the synergy take and when will it start to affect cash flows (the longer the synergy takes to be captured, the less value it should be given). Adopting this methodology, firstly, the acquiring and target company should be valued separately on the basis of discounting expected cash flows to each company at the weighted average cost of capital for that company (commonly referred to as a discounted cash flow/DCF). Secondly, the value of the combined new organization (with no synergies) should be estimated, by aggregating the discounted cash flow values obtained for each company on a separate basis (per step one). Finally, the effects of synergies, expected growth rates and incremental new cash flows should be added to the value of the combined new organization (per step two). The difference between the value of the combined new organization with/without synergies provides an estimate of the synergies associated with the deal in question.

The higher the premium an acquirer pays for a target, the lower their potential for synergistic gains. When it comes to estimating synergies, hidden costs such as adverse reactions to the deal and miscellaneous spending should be factored in (which are dilutive to value and serve to effectively increase acquisition costs). Acquirers often focus purely on the benefits of a deal during pricing analysis. However, follow-on investments may be required before synergies can be fully realized. Implementation costs associated with a post-merger exercise must also be considered. Failure to consider these “hidden costs” can easily result in the acquirer assigning an inflated value to a target.

Synergies may arise from four main sources:

- Revenue increases – these can be achieved via selling a greater quantity of goods and services via broader distribution channels (including new geographies);

- Cost rationalization – the new organization may streamline its variable and fixed cost base – such as via removing duplicate office functions and surplus employees;

- Process optimization – this can be achieved by implementing more efficient marketing tactics and strategies, re-branding exercises, adopting innovative technologies and utilizing more efficient distribution channels;

- Financial rationalization – a larger, new organization may benefit from a lower cost of capital, tax benefits and higher debt capacity, etc.

A three-step approach can be taken to estimating synergies:

10 Ways to Estimate Synergies

- Estimate the value saved via sharing resources that are not 100% utilized (i.e. machinery, vehicles, computers, etc.);

- Estimate operating efficiency improvements via sharing “best practices”;

- Estimate opportunities to increase revenue by cross-selling products/services or increase prices by eliminating a competitor;

- Estimate costs savings associated with improving distribution strategy by serving customers in close geographical proximity;

- Identify ways to consolidate suppliers and negotiate better terms with them via leveraging economies of scale and purchasing goods/services at lower prices;

- Analyze head office function savings by combining offices (saving rent, etc.) and business functions (such as finance and HR);

- Analyze headcount and identify any staff surplus to requirement (for instance, it is unlikely two finance directors will be required);

- Identify where professional/consulting services fees can be reduced;

- Identify approaches to human capital improvements – for instance, leveraging the increased size of the combined organization to attract superior talent;

- Estimate how hiring in other countries (if a target has overseas operations) can reduce labor costs.

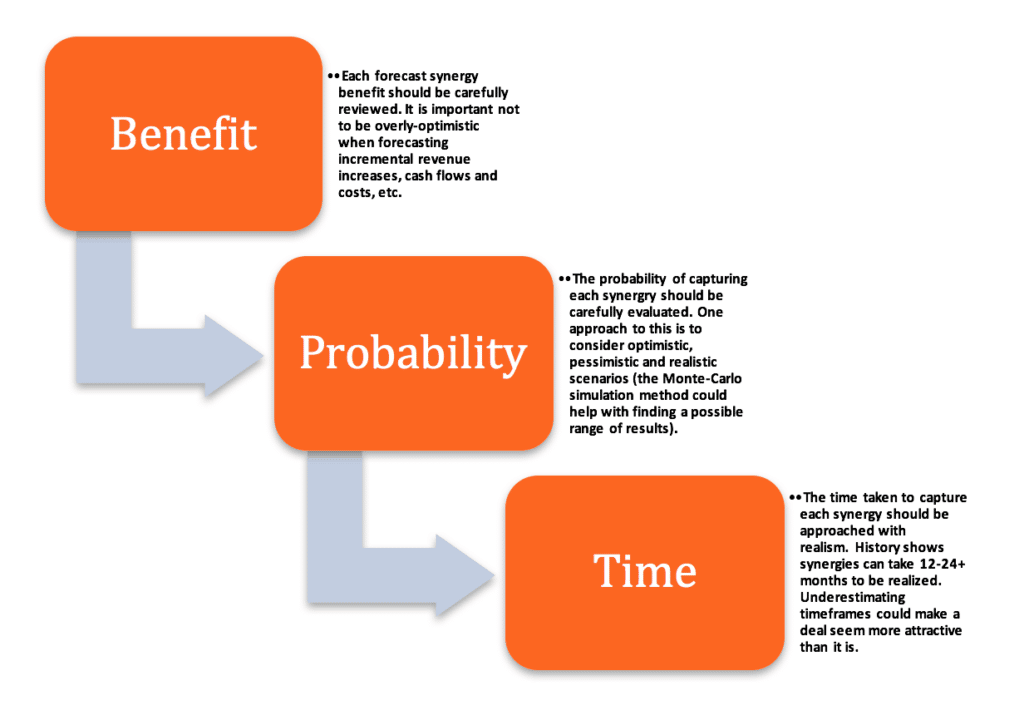

Managing Risk

The difficulties associated with capturing synergies are often underestimated. Synergies are typically captured 12-24+ months after a deal closes. This is termed the “phase in” period, where operational efficiencies, cost savings, and new revenue streams are gradually introduced into the new organization. In the short term, costs may actually increase via one-off integration expenses and short-term inefficiencies due to employees not having worked together before and culture clashes. Crucially, if a culture clash is too great, synergies may never be realized.

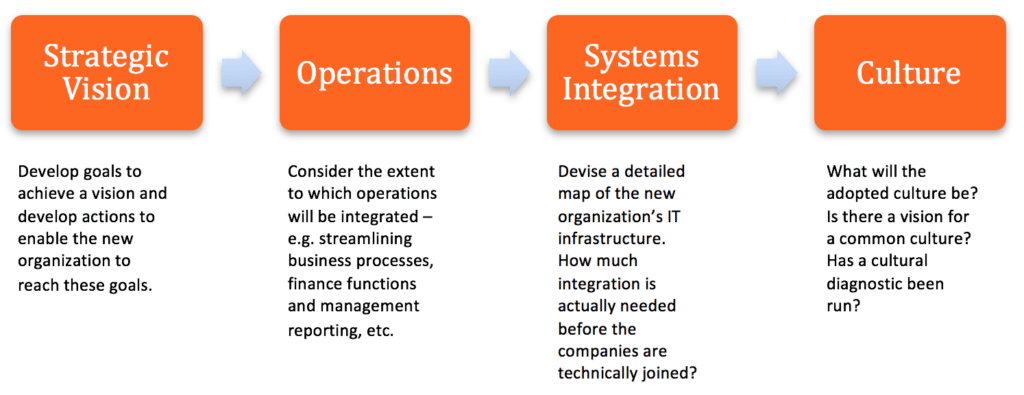

Across the post-merger integration process, acquirers must keep in mind a vision of the newly combined organization as distinct from the two or more constituent companies, building towards it on an on-going basis. This vision must also be communicated exhaustively to staff and stakeholders, ensuring they understand where operations are to aligned and why the combination will lead to better outcomes overall.

Steps must also be taken to protect the individual business operations of the companies coming together. Despite the best intentions of all involved, sometimes cultures are incompatible and sometimes companies are simply better off apart. Protecting the key assets, processes and relationships of the two companies is therefore a crucial part of minimizing risk in the post merger-phase.

Takeaway

Synergies are what make the M&A world go round. Examining a target’s assets, operations and competitors can tell you a lot, but acquirers should never fool themselves that a deal is a sure-fire winner. Far better is to build as comprehensive a picture of a target as possible, and what the combined new organization could look like, before striving to bring that vision to life.

Download our comprehensive Guide to Post-Merger Integration to learn more.