In a recent blog post, we covered current trends and best practices for target scoring (a.k.a. deal scoring) — the process that provides programmatic serial acquirers with a methodical way to manage their pipeline of opportunities and rate potential targets against custom criteria.

Corporate development teams need to constantly organize opportunities, sorting by deal hypothesis and using key metrics to evaluate strategic fit. This can be an arduous process, sucking up hours of time (and money) on research and data entry. The secret to sourcing great deals over and over again is building a great workflow, and that all starts with streamlining your deal scoring.

Determining your company’s standard deal scoring process is sure to provide lasting dividends in business growth and team efficiency. Here’s how.

Why It Works

Automated deal scoring allows serial acquirers to sort through targets in a shorter timeframe, custom fitting the way their pipeline reflects companies with a positive fit and marking those who don’t.

The ability to freely swap between pipeline processes in order to rate targets against different criteria is a huge time saver. Additionally, customizing your reports and scoring criteria to your ideal fit reduces the amount of time spent on unqualified leads while increasing the number of deals your team can vet.

Screening Targets on Pipeline+

Our deal scoring feature automatically assigns a numerical value to targets on your pipeline so that your team can quickly develop a deal thesis and identify actionable opportunities without hours of mundane analytical research.

Pipeline+ awards points to your targets for hitting metrics determined by your team. Without the legwork and constant research on your end, your team can simply filter for the targets that score a high-enough rating to merit your full attention and work from there.

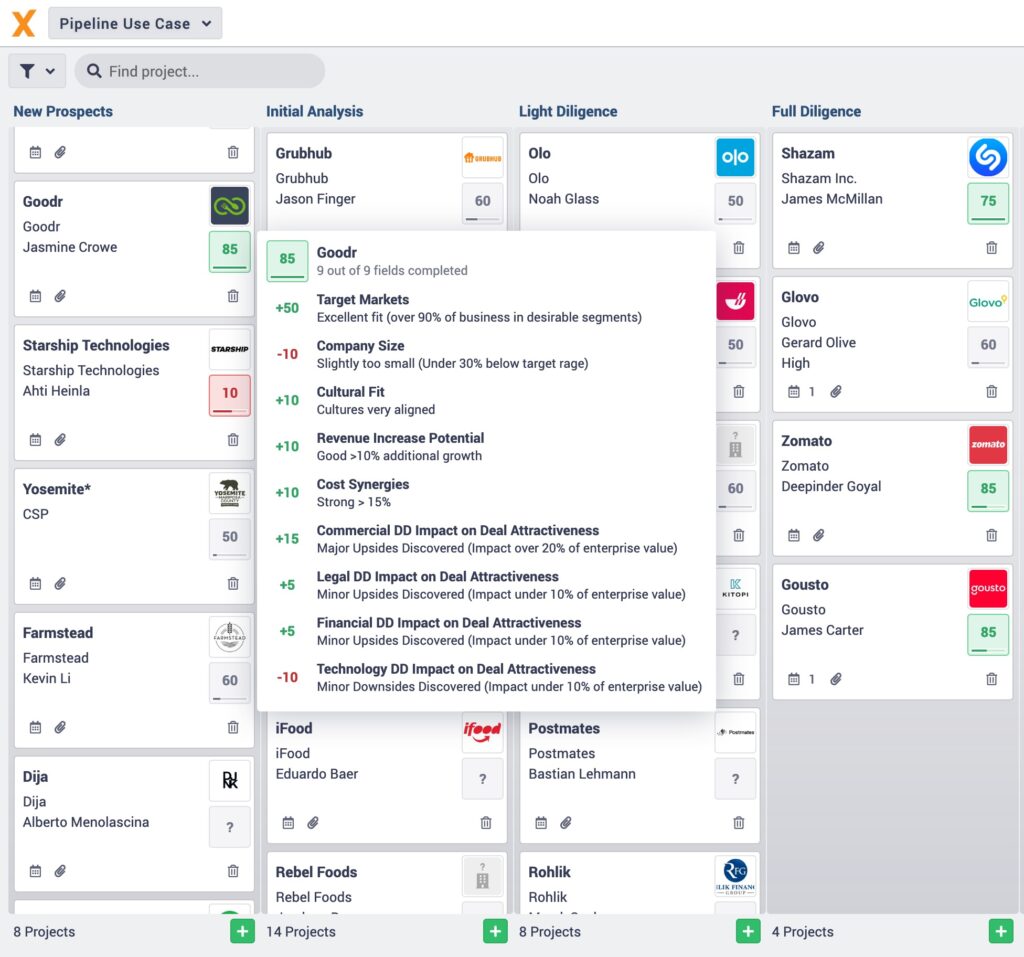

Here’s how our tool looks in-app. Below each company logo, you will find a color-coded score representing each target’s Deal Score.

Predefined color coding; A score of 0 to 30 reflects as red, 30 to 65 displays gray, and 65 through 100 shows green.

Clicking on any score brings up a scoresheet that breaks down what details are impacting a company’s ranking, as well as the number of points awarded or deducted from the score. Use this tool to make swift, strategic decisions and assess more targets in a shorter time frame.

Best Practice Score Evaluations

We have considered two ways of looking at and setting up your deal scoring within Pipeline+: delta baseline score (or) all fields summed up.

With the baseline approach, one or two fields set a baseline score and other factors affect said baseline positively or negatively (or neutrally). Selecting “target market fit: good” alone as your baseline gives the fictitious deal below a score of 50. Populating other fields then negatively or positively changes the score. Note: the score gets more accurate as more information is populated and the baseline score reflects any value or metric you value most.

Example Calculation:

- Target market fit: Good 50pts

- Culture fit: Mediocre -10pts

- Size fit: Great +10pts

- Total = 60pts

We can compare this to the summed-up approach where all fields add up like so:

- Target market fit: Good 30pts

- Culture fit: Mediocre +0pts

- Size fit: Great +30pts

- Total= 60pts

With the summed-up approach, the score typically looks quite low until most fields have been populated.

Final Thoughts

Corporate development teams that analyze what has worked in the past, determine a standard for deal scoring, and use tools to avoid hours of research are the ones that avoid reinventing the wheel every day — and that source higher quality deals, faster.

For a detailed breakdown on our solution, visit our Deal Scoring Feature Page to learn how you can enable your corporate development team to source 5x more deals and better identify your perfect fit.