Whether the objective is obtaining a new business unit by acquisition or merger, re-organizing different divisions of a company or building up an in-depth partnership, a successful integration can be a challenge. Creating an operative base to reach strategic M&A goals may take a long time – indeed, post-merger integration processes often take much longer than expected, causing frustration and requiring patience from both parties.

Treating post-merger steps as projects and dividing these into key phases is crucial. This will allow management to focus on communication, information flows and on transforming the strategic goals of M&A into specific integration actions. Management’s true desire to succeed will help solve even difficult matters in good cooperation, while lack of interest may make achieving results impossible. Furthermore, previous integration experience and learning from earlier cases will help create value from an M&A project.

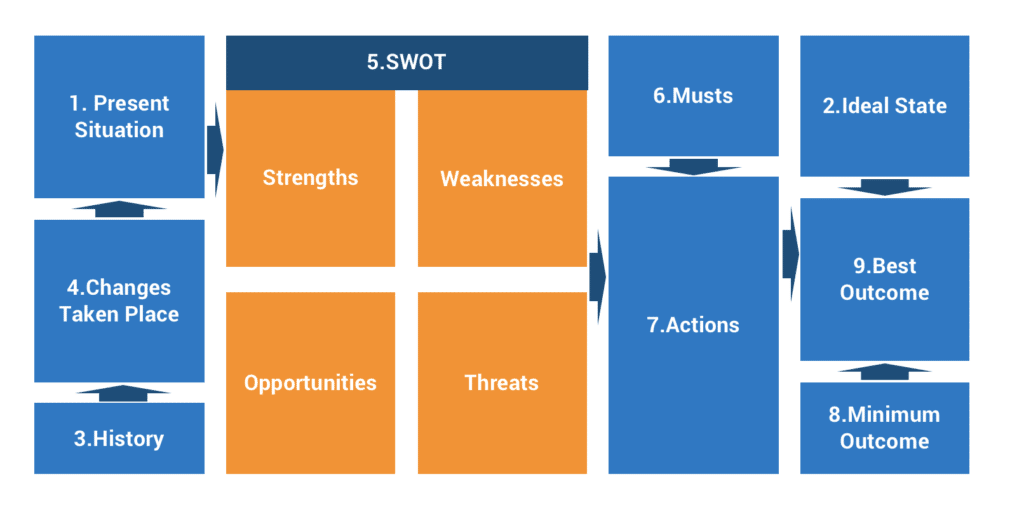

The overall action planning path of an integration project can help the new organization commit to a plan and execute with a shared mindset, priorities and means. The steps in the path guide the pattern of work across the integration project, and are pictured below:

The above steps are further explained below:

- Present situation described by way of a short summary.

- Ideal state – i.e. what is the dream organization state following M&A?

- History – i.e. what is important to keep in mind from the history/histories of the companies and/or business units involved in M&A? What have they done in the past and what results have they achieved? Where could the main sources of problems originate?

- Changes taken place – what have been the main changes, are they completed or are there still unfinished projects? What lessons have been learned and what is the change capacity?

- SWOT: summarize the strategic point of the M&A project (or part of it). Internally, question what are the strengths and weaknesses? Externally, question what are the opportunities to fight for and the threats to avoid?

- Musts: Goals can be divided into two categories. Musts are goals which have to be achieved. Another category can list all other good aspects, such as “objects of desire”.

- Actions: what must be done to gain the Musts?

- Minimum outcome: what would be the minimum acceptable outcome in order to respond to the change situations? This will give clear priority for actions and help people focus their efforts on the most important issues.

- Best outcome: defines the ambition that would represent a big leap in the future direction and would generate a successful M&A outcome.

Integration Action Plan Pathway

An Integration Action Plan should follow this pathway:

The action plan path outlined above may be experienced as an over-structured process, where detailed action points are related to each step. At the same time, the overall picture will remind people of what must be done before there is a proper plan.

Action plans can be delegated to different teams/workstreams (and experts) using a process map to summarize the analysis behind decisions made.

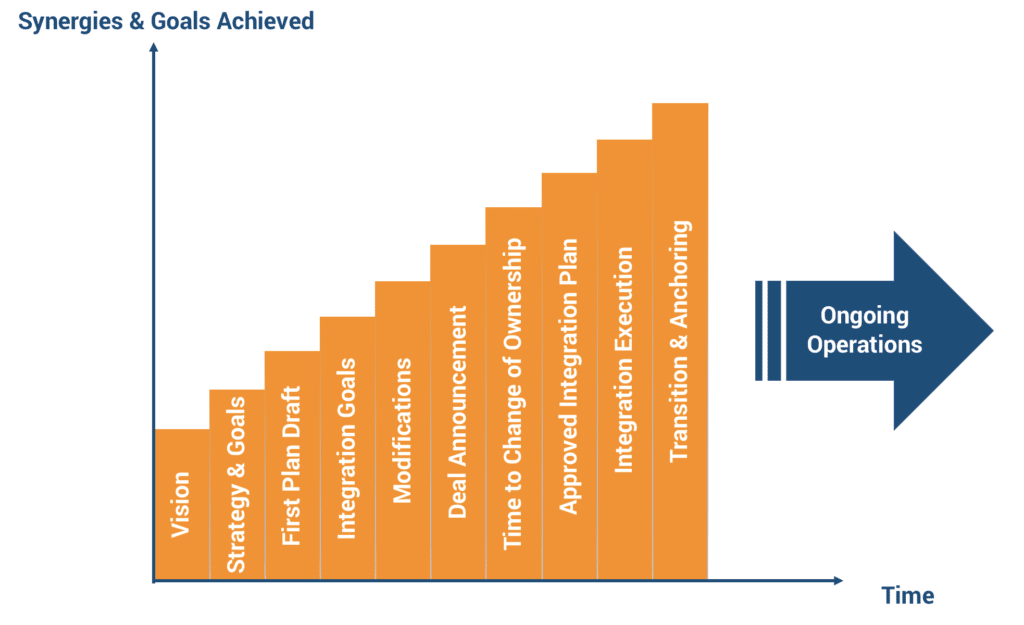

An Evolutionary Process

Integration planning and execution is an evolutionary process.

- The process starts from a faint idea or vision – through discussion, research and refinement, it becomes one of the strategic ways in which the organization plans to grow/change.

- Each planning phase brings more information and knowledge of the target and the ways integration could proceed.

Use of a post-merger integration template featuring process phases will facilitate planning, setting of goals, assignment of tasks and measurement of results. It will also allow the top managers to continuously look back and review progress against original goals. This enables management to follow up on whether decisions and implementation steps planned truly are the best ways to reach these goals.

Setting You Up for Success from Day One

It is essential to ensure that acquisition & integration objectives are defined, communicated and understood across the integration team as early as possible.

If you’re looking for clear best practices, read more on M&A integration strategy and best practices.

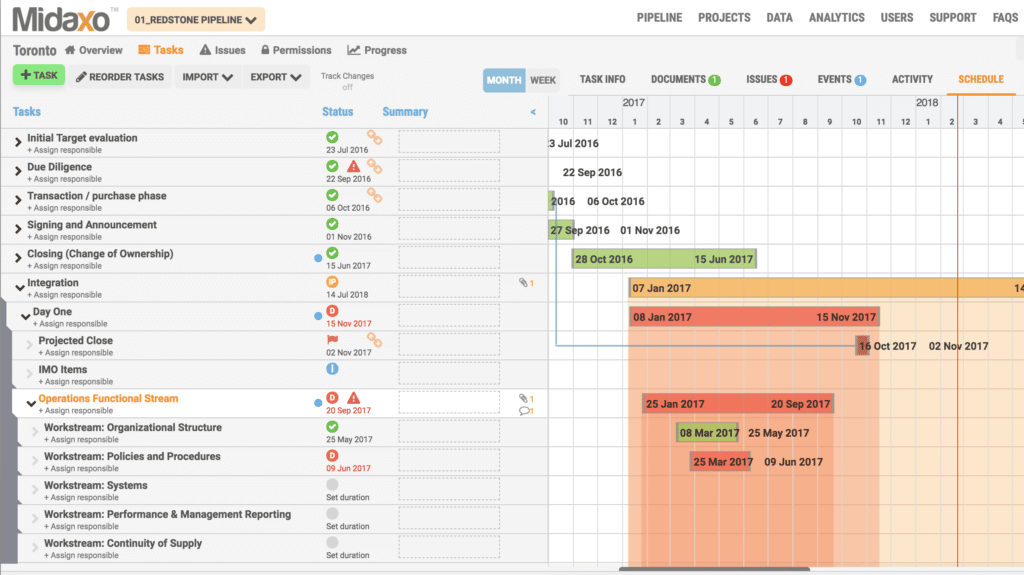

From Analogue to Digital

If you’re ready to move off a static Excel checklist then now is the time to consider digitalizing your approach to integration and other areas of M&A. Midaxo enables users to import an existing post-merger integration checklist with a couple of clicks and run integration projects in real-time.

Midaxo can enable you to accelerate your PMI process by up to 40%, capture synergies more quickly and maximize deal value in ways not possible with an analogue approach. M&A software provides the ability to run projects simultaneously, track all documents, communications and issues from a centralized platform, supporting the creation of a systematic and repeatable M&A process.