Midaxo Blog

Featured BLOG

Unleashing Corporate Development Success: Programmatic M&A Strategies and Cloud Technology

In the ever-evolving landscape of mergers and acquisitions (M&A), the key to success lies not just in strategic decision making but in the execution of those strategies. Programmatic M&A, combined with the transformative capabilities of cloud technologies, has emerged as a powerful tandem that can drive seamless, efficient, and successful deals. As the McKinsey article …

Latest Posts

Unleashing Corporate Development Success: Programmatic M&A Strategies and Cloud Technology

In the ever-evolving landscape of mergers and acquisitions (M&A), the key to success lies not just in strategic decision making but in the execution of …

Why Teams Need Living M&A Playbooks: Navigating the Complex Landscape of Corporate Development

Inorganic growth through M&A and corporate development has become an integral strategy for companies seeking innovation and competitive advantage. However, the journey to successful inorganic …

The Case for an Integrated VDR in your Corporate Development Practice

Virtual data rooms (VDRs) are an invaluable tool for companies, investors and other entities to securely store and share the vast amounts of documentation involved …

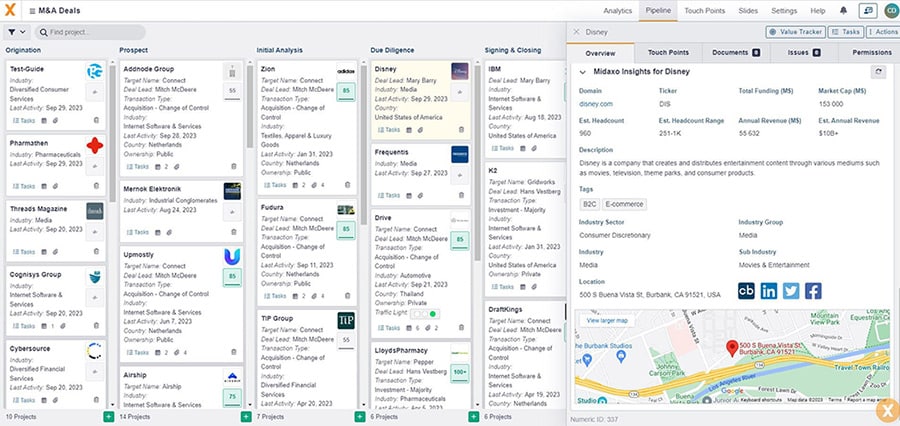

A New Way of Doing Corporate Development with Midaxo Cloud

In the ever-evolving landscape of M&A and corporate development, staying ahead of the curve is essential for sustained growth and success. The traditional methods of …

M&A Trends and 2024 Outlook from Industry Experts

As we entered the last quarter of 2023, corporate development leaders, in-house counsels and private equity investors discussed a wide range of trends and issues …

Mastering Technology Due Diligence and Integrations

During a live Q&A in September — 7 Tips and Tricks for Successful Technology Due Diligence and Integrations — Mart Lumeste, Co-Founder of Intium Tech …

Other Resources

Learn How Midaxo Can Power Your Dealmaking

Contact us for a live demo or simply to discuss how Midaxo can improve the productivity of your team